Managing your finances can be a daunting task, but thanks to technology, it doesn’t have to be. There are a plethora of money management apps available for iPhone users, each designed to help you keep track of your spending, create budgets and save money. Here, we’ve compiled a list of 20 money management apps for iPhone to help you take control of your finances.

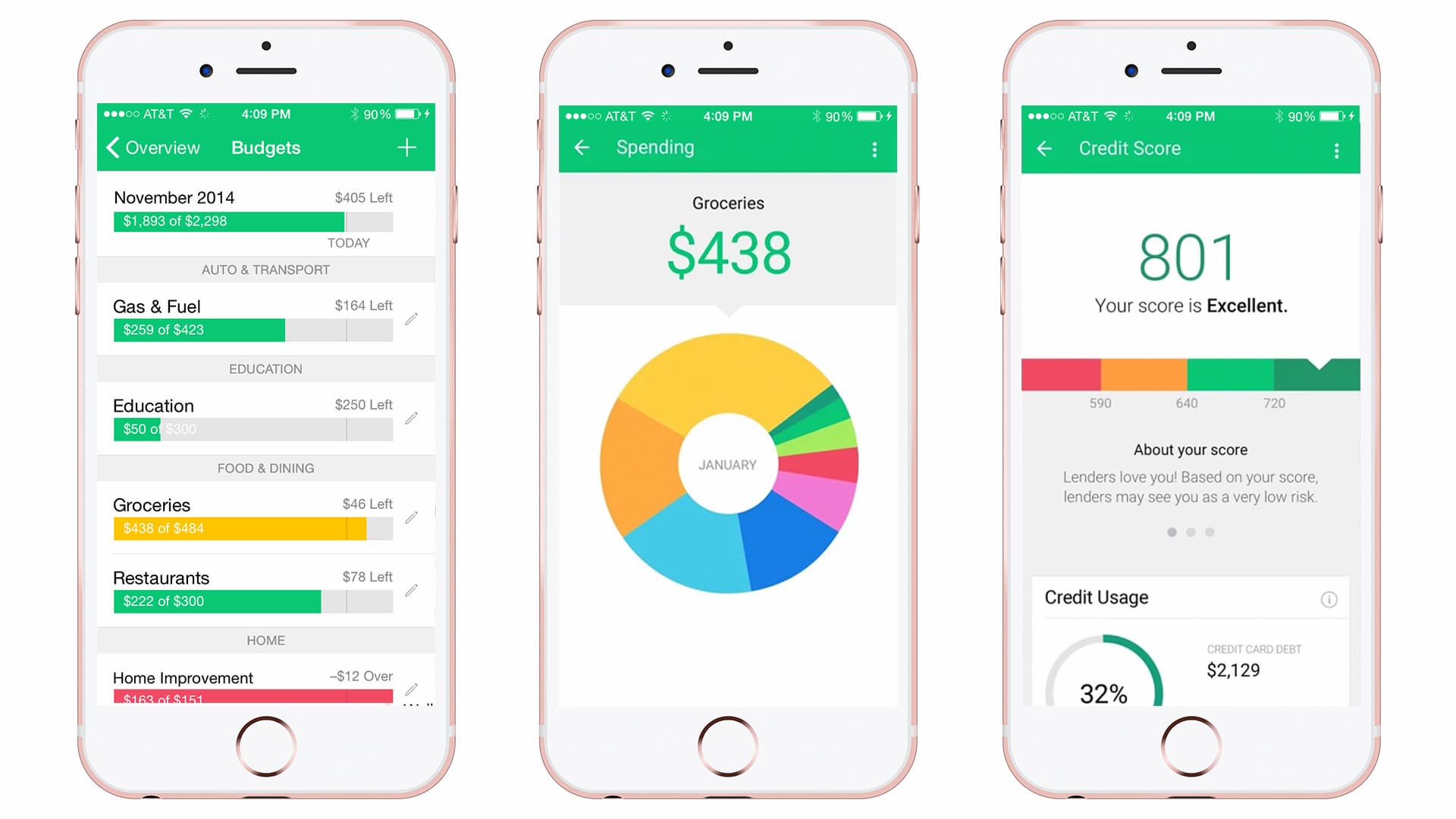

Mint

Mint is a free app that allows you to view all of your financial accounts in one place. You can create budgets, track your spending and receive alerts when bills are due. Mint also offers free credit score monitoring.

Personal Capital

Personal Capital is a free app that offers a comprehensive view of your financial situation. It allows you to track your spending, create budgets, and monitor your investments. The app also offers free financial planning services.

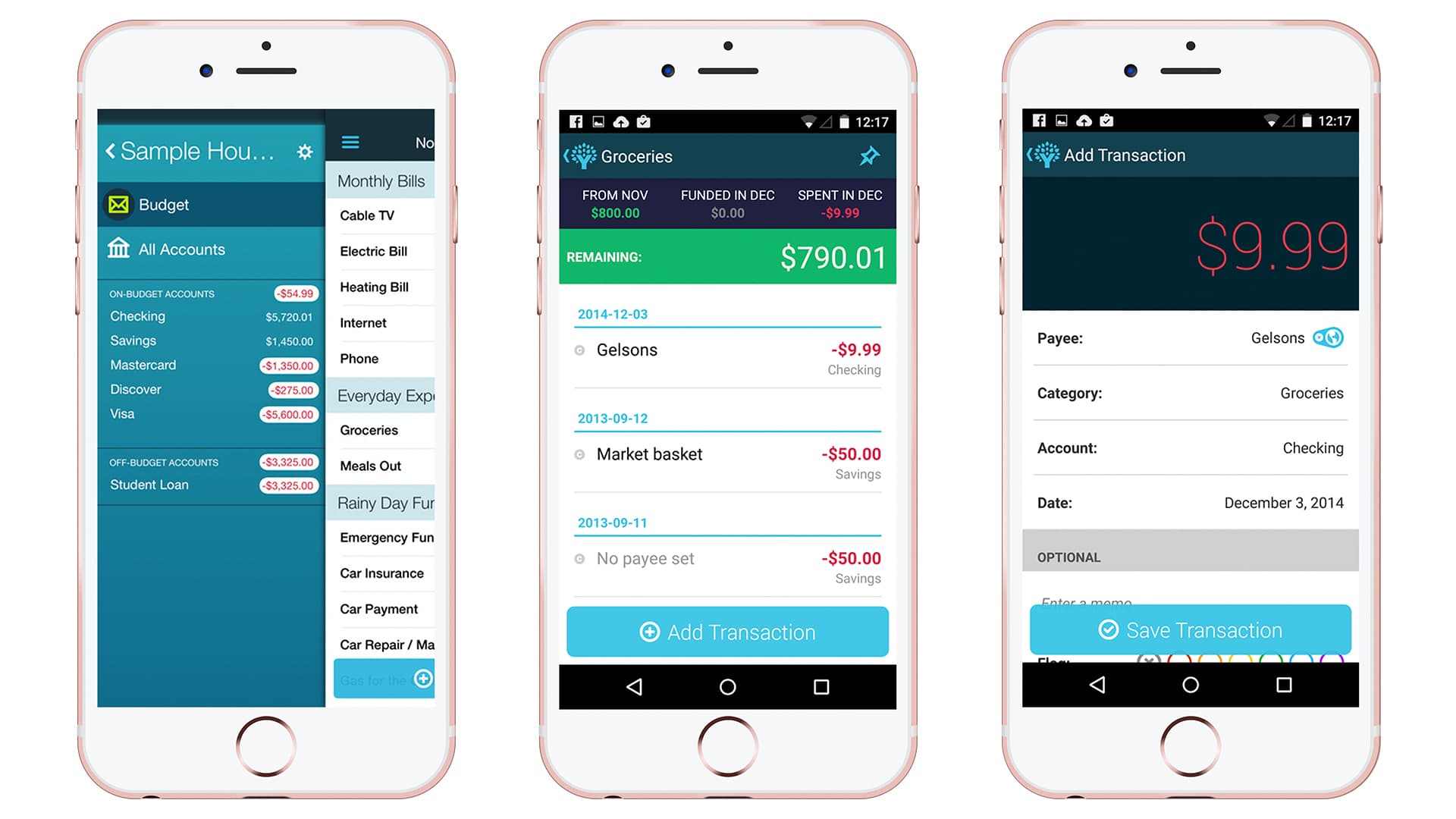

You Need a Budget (YNAB)

YNAB is a paid app that helps you create a budget and stick to it. It allows you to track your spending and offers helpful tips and tricks to help you save money. The app costs $11.99/month or $84/year.

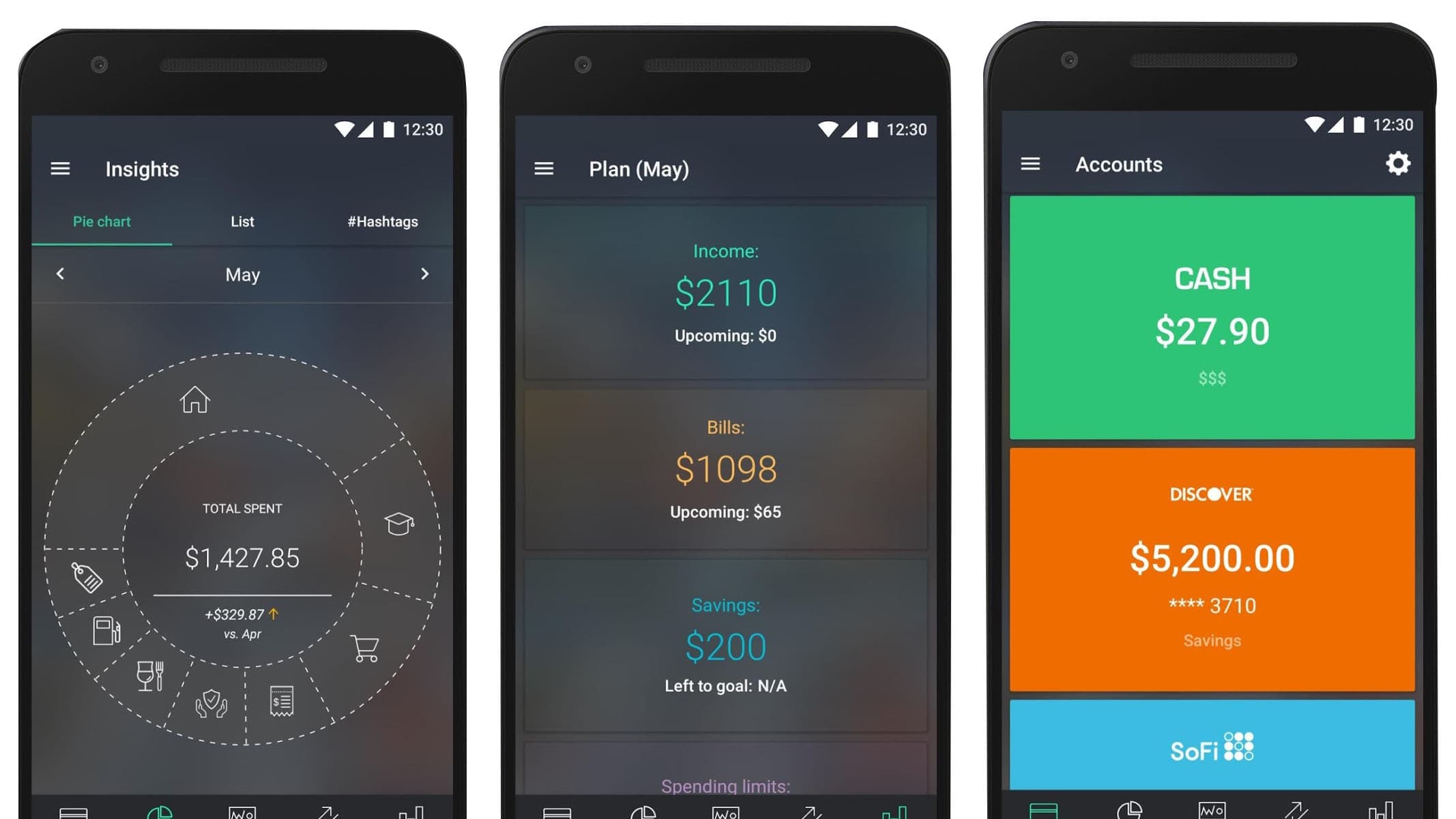

PocketGuard

PocketGuard is a free app that helps you keep track of your spending and create a budget. It also offers personalized saving tips and alerts you when bills are due.

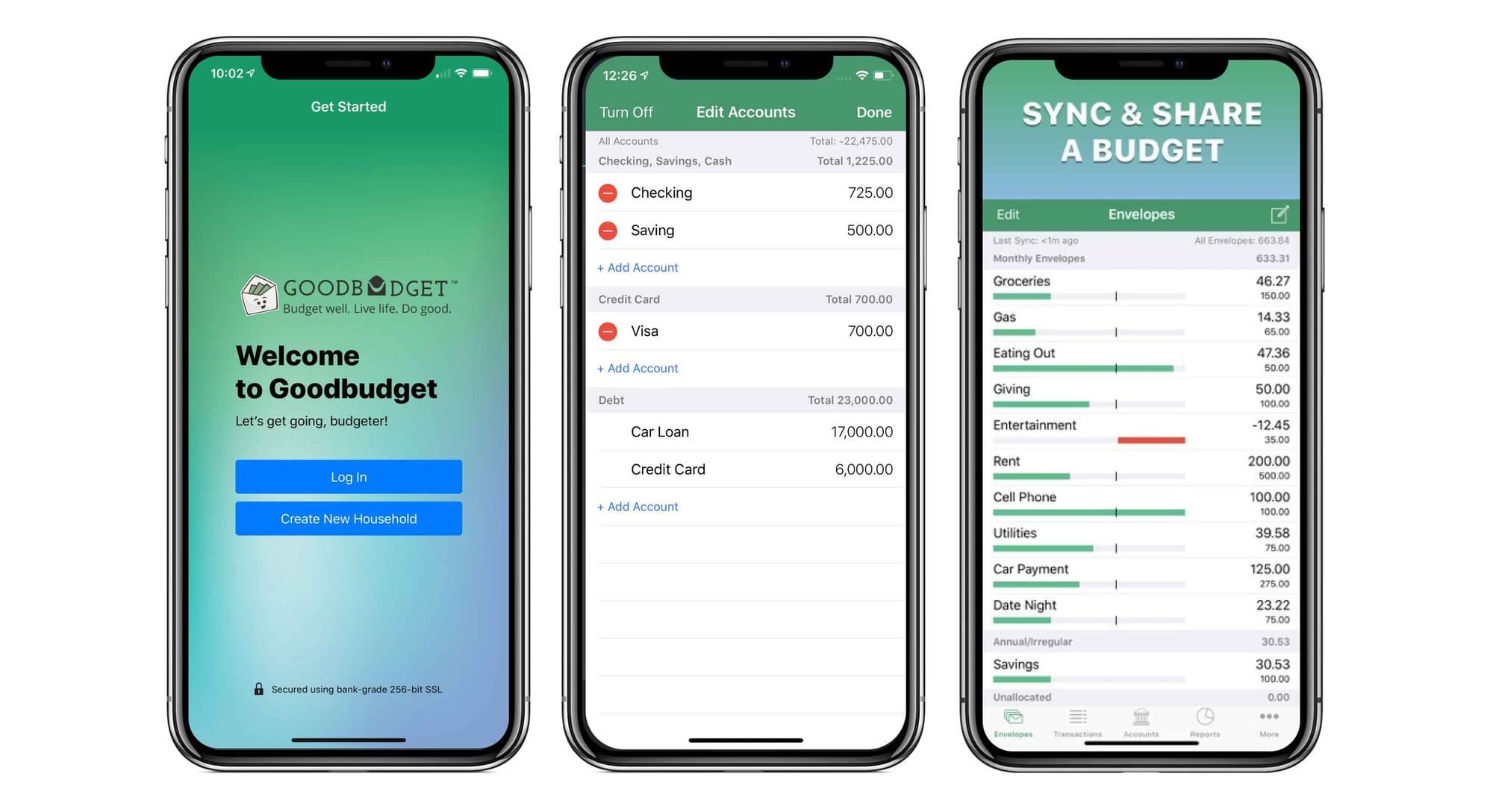

Goodbudget

Goodbudget is a free app that uses the envelope budgeting method to help you stay on track with your spending. It allows you to create virtual envelopes for different expenses and provides insights into your spending habits.

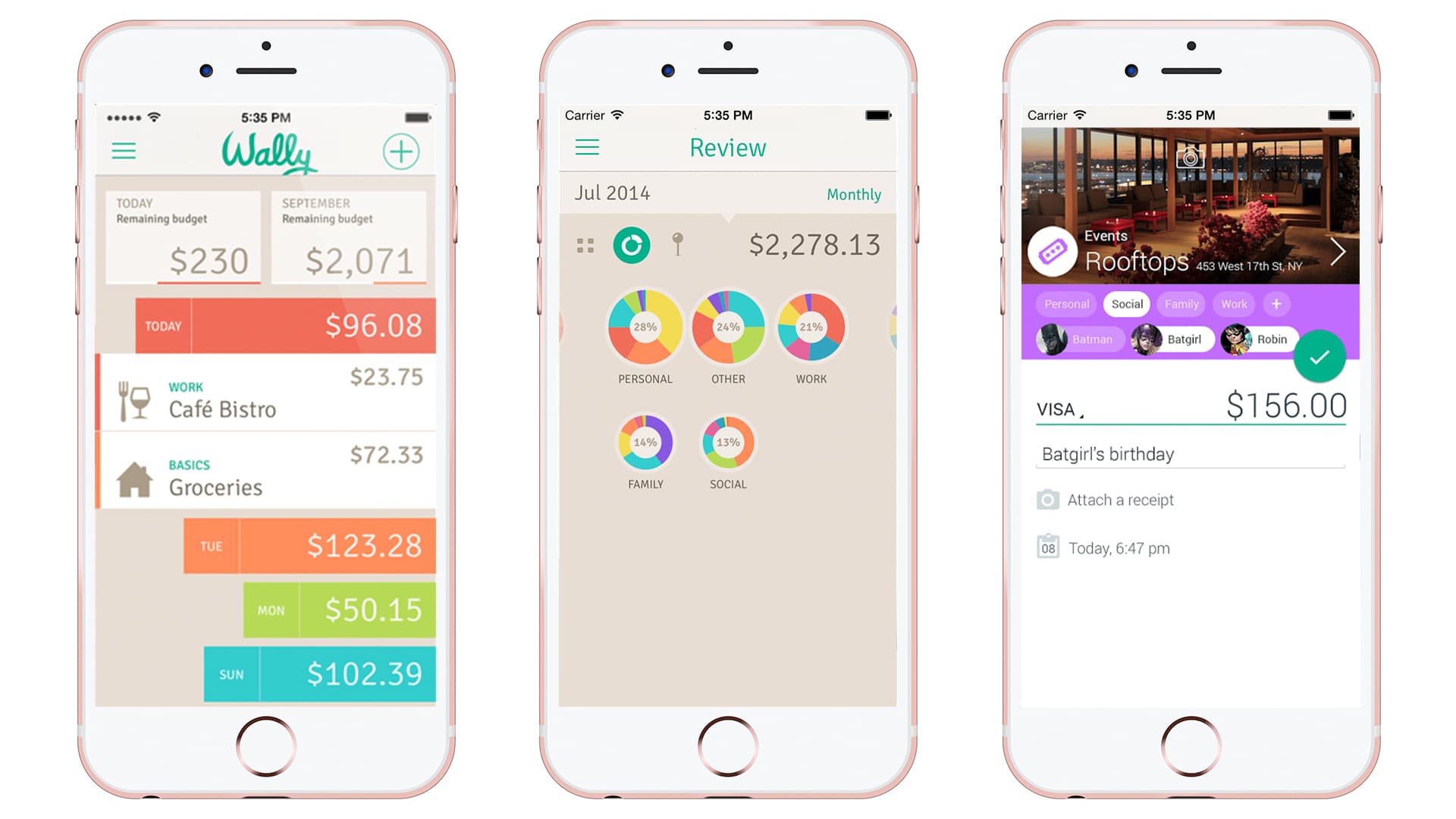

Wally

Wally is a free app that allows you to track your expenses, create a budget and set financial goals. The app also offers helpful insights into your spending habits.

Mvelopes

Mvelopes is a paid app that uses the envelope budgeting method to help you stay on track with your spending. It allows you to create virtual envelopes for different expenses and syncs with your financial accounts. The app costs $6/month or $60/year.

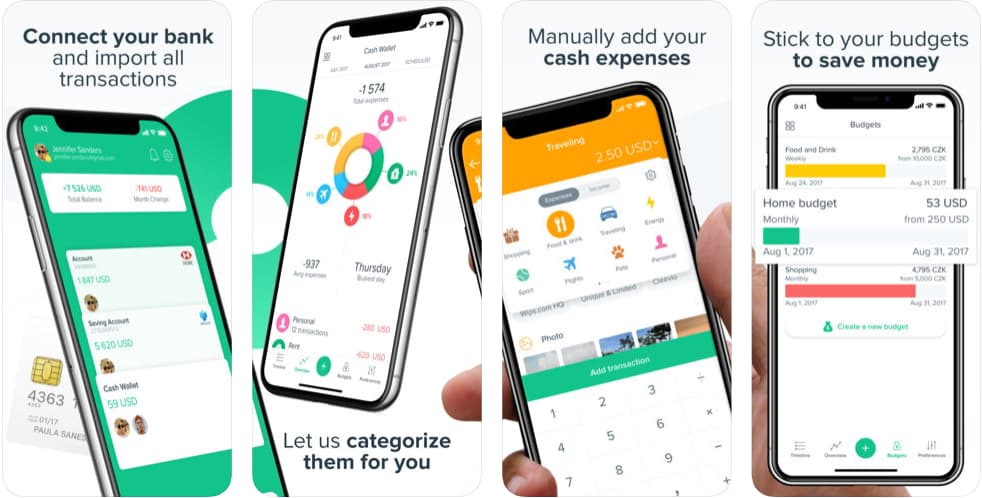

Spendee

Spendee is a free app that allows you to track your spending and create a budget. It also offers helpful insights into your spending habits and allows you to share expenses with friends and family.

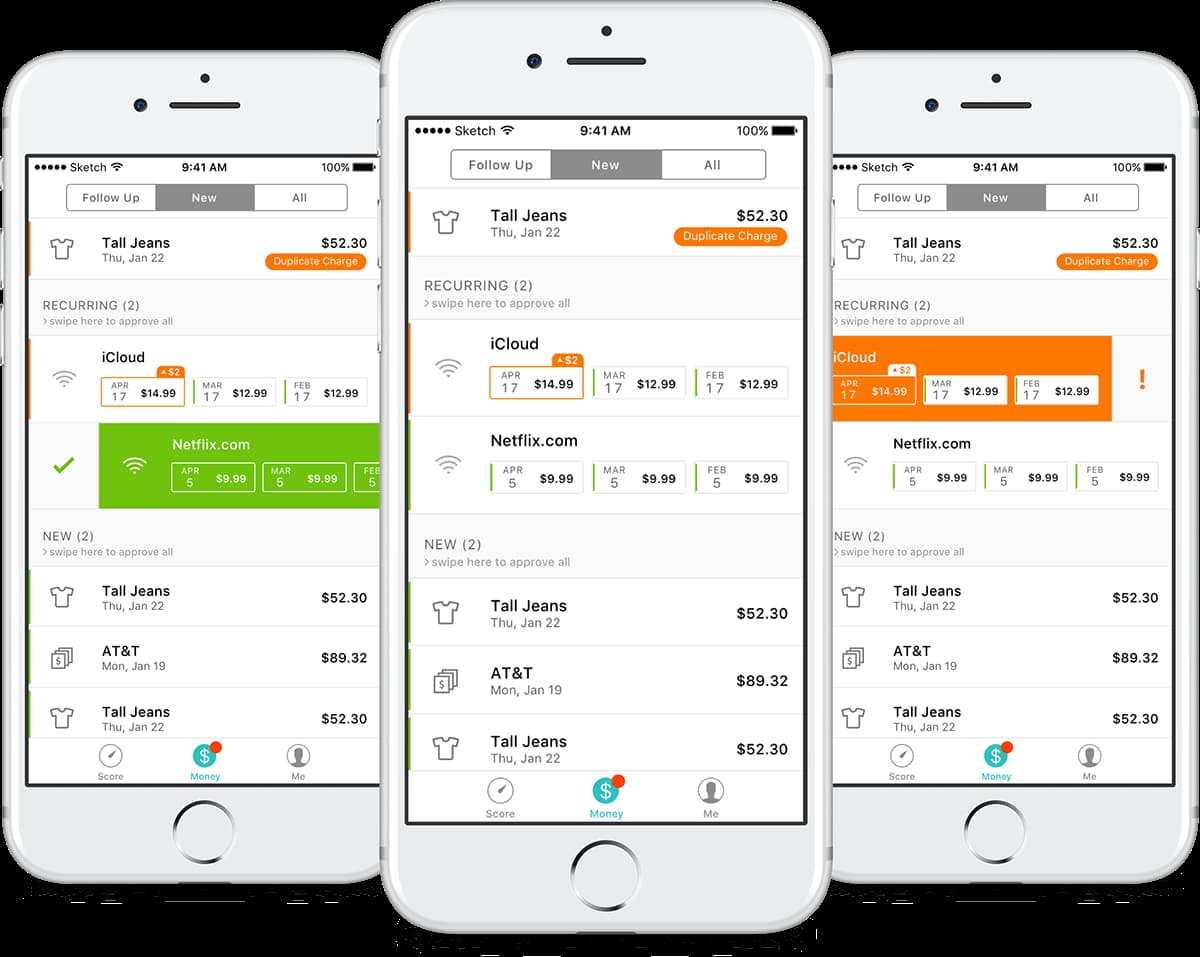

BillGuard

BillGuard is a free app that alerts you to fraudulent or unauthorized charges on your credit cards. It also allows you to track your spending and monitor your credit score.

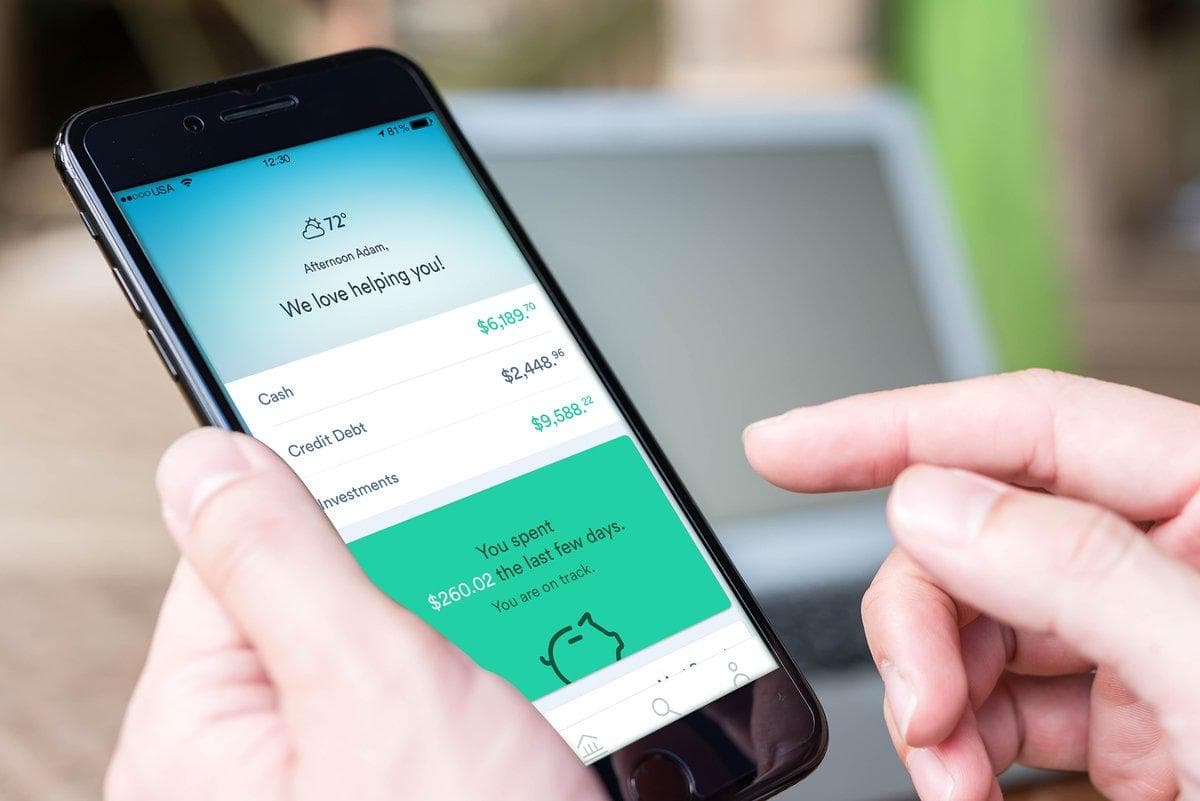

Clarity Money

Clarity Money is a free app that helps you track your spending, create a budget and save money. It also offers personalized money-saving tips and alerts you to subscription fees you may be paying.

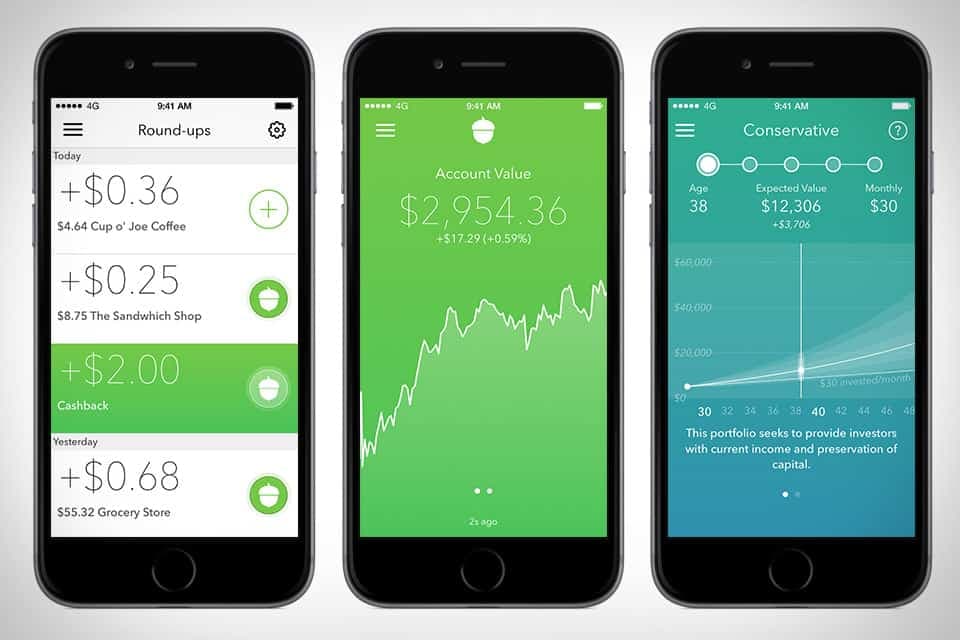

Acorns

Acorns is a paid app that allows you to invest your spare change automatically. It also offers personalized investment advice and financial planning tools. The app costs $1/month for accounts under $1 million and 0.25% for accounts over $1 million.

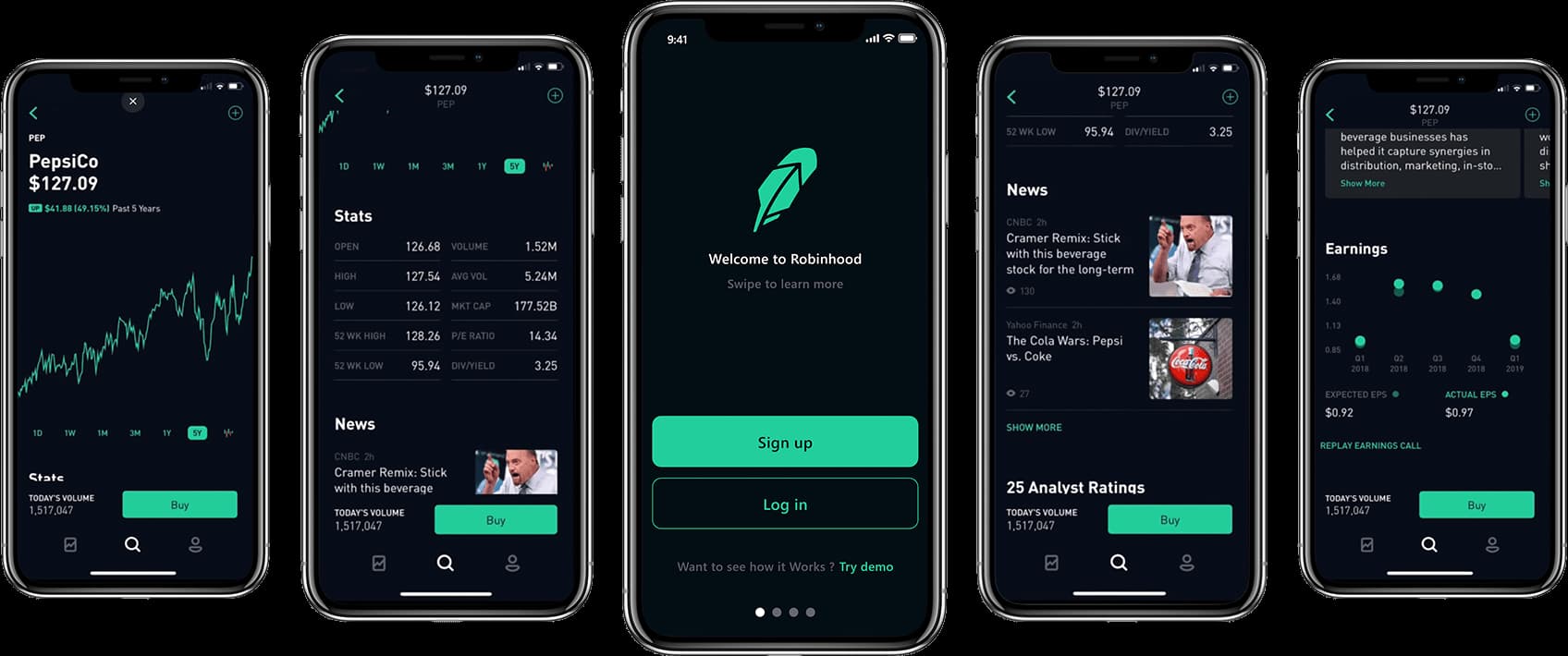

Robinhood

Robinhood is a free app that allows you to invest in stocks, ETFs, and cryptocurrencies without paying commission fees. It also offers a range of financial tools and resources to help you make informed investment decisions.

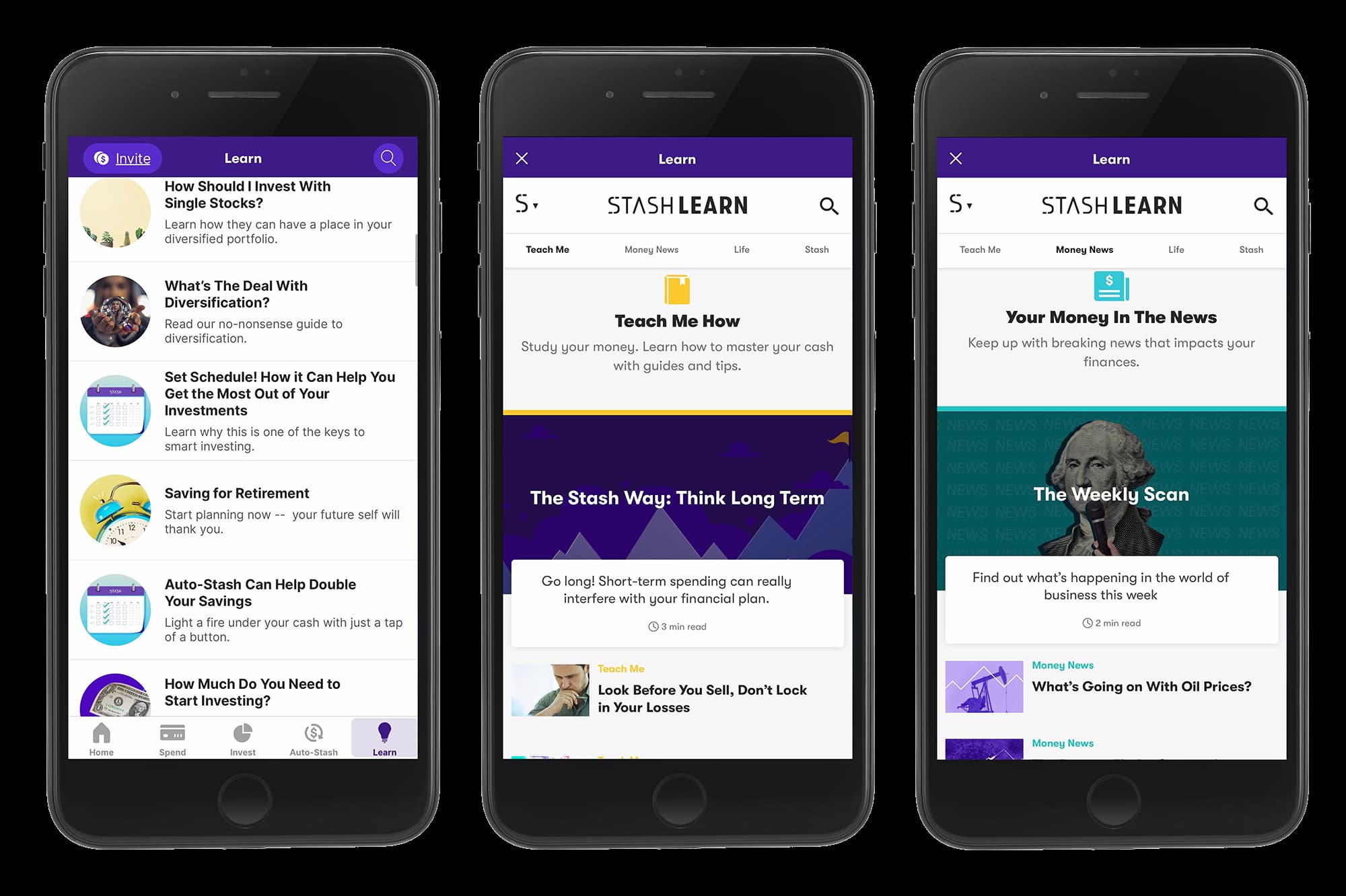

Stash

Stash is a paid app that allows you to invest in stocks and ETFs with as little as $5. It also offers financial education resources and personalized investment advice. The app costs $1/month for accounts under $5,000 and 0.25% for accounts over $5,000.

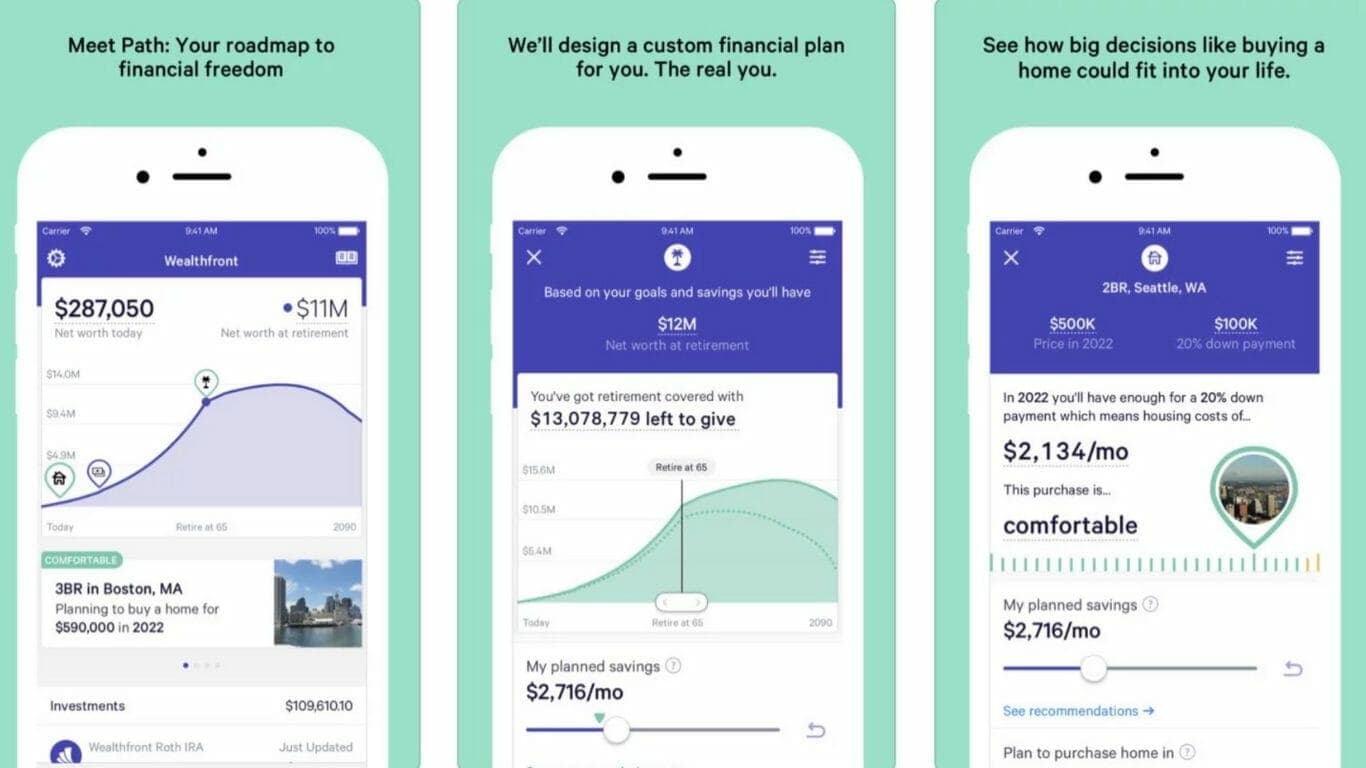

Wealthfront

Wealthfront is a paid app that offers automated investing and financial planning services. It also offers free financial advice and a range of investment options. The app charges 0.25% annually for accounts over $500.

Honeyfi

Honeyfi is a free app designed for couples to manage their finances together. It allows you to track your spending, create a budget and share financial goals. The app also offers personalized saving tips and alerts when bills are due.

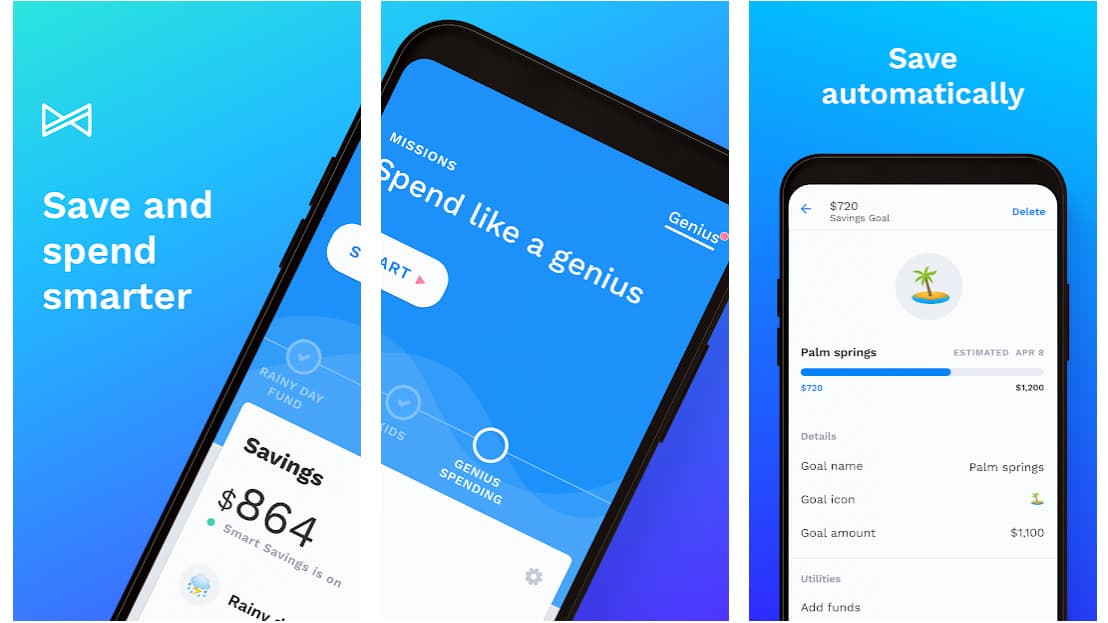

Albert

Albert is a free app that uses artificial intelligence to help you manage your money. It allows you to track your spending, create a budget and save money automatically. The app also offers personalized investment advice and financial planning services.

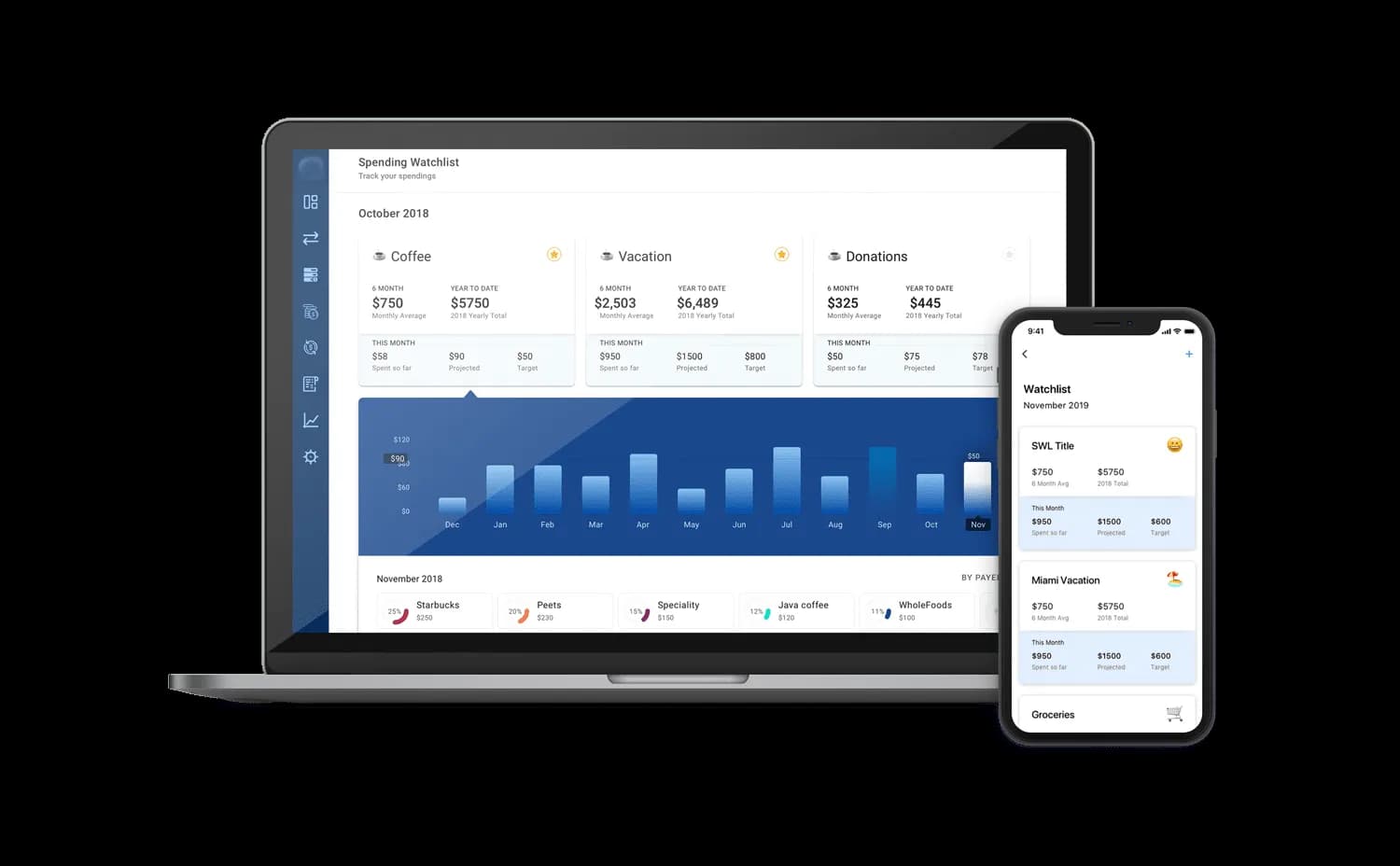

Simplifi

Simplifi is a paid app that allows you to view all of your financial accounts in one place. It allows you to track your spending, create a budget and set financial goals. The app also offers personalized insights and alerts when bills are due. The app costs $3.99/month or $39.99/year.

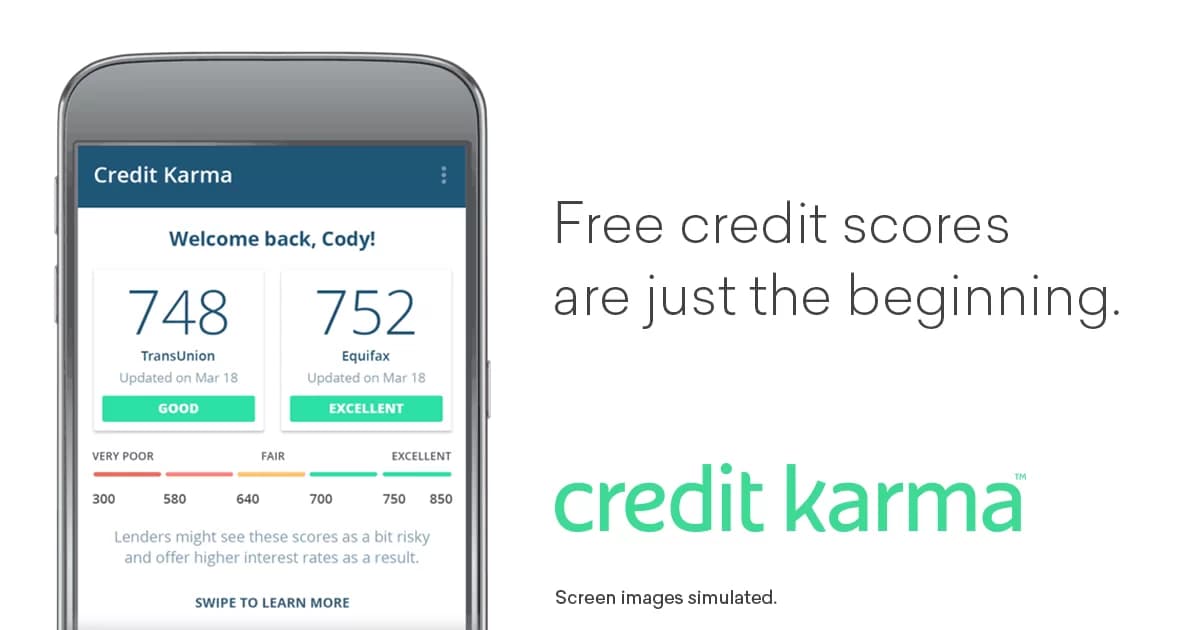

Credit Karma

Credit Karma is a free app that offers free credit score monitoring and financial advice. It allows you to view your credit report and provides personalized recommendations for improving your credit score. The app also offers tools for managing your spending and creating a budget.

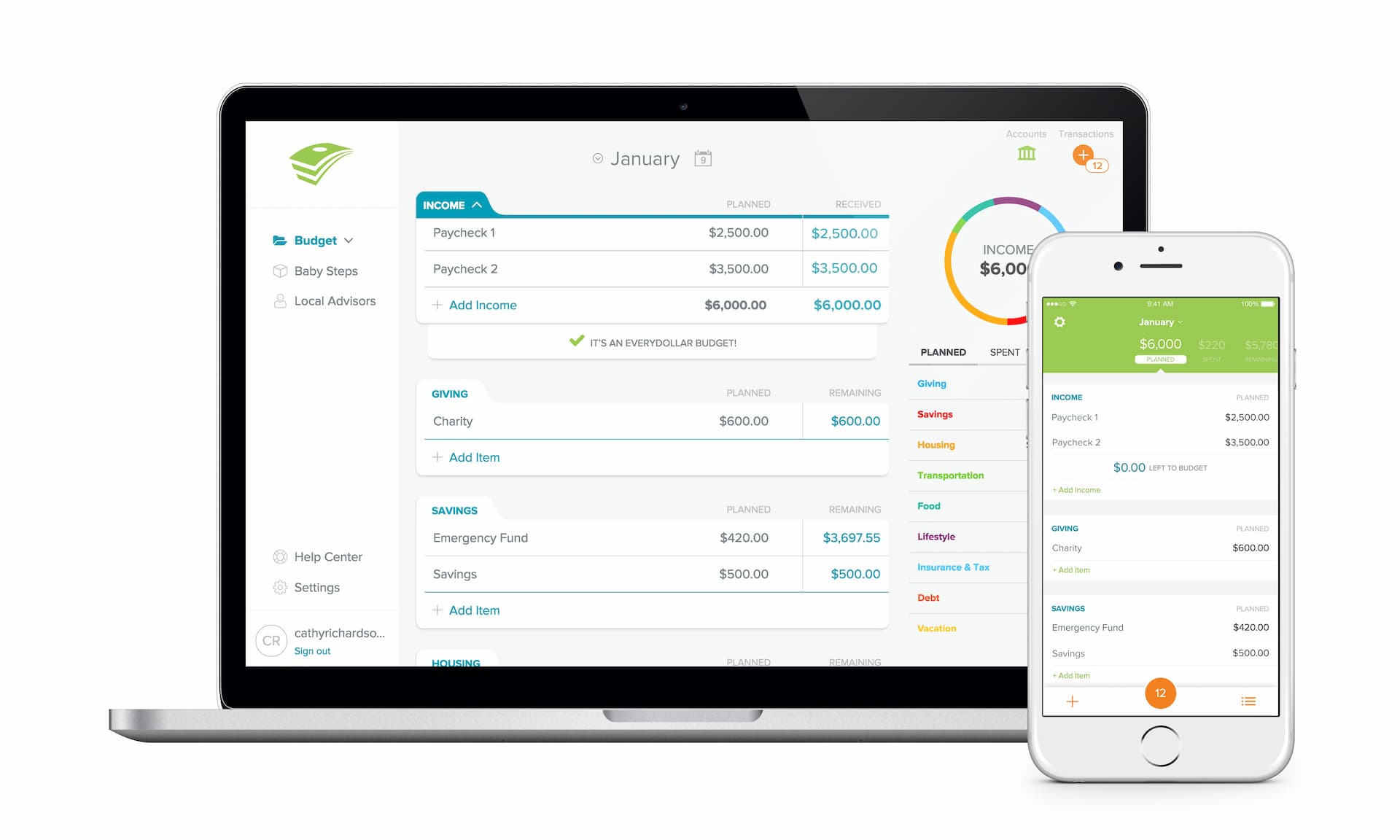

EveryDollar

EveryDollar is a free app that uses the zero-based budgeting method to help you manage your money. It allows you to track your spending and create a budget based on your income and expenses. The app also offers financial advice and resources for saving money.

These money management apps for iPhone can help you track your spending, create a budget, and save money. Whether you’re looking for a free app or a paid app with more features, there’s an option out there for everyone. It’s always a good idea to consult with a financial advisor or your local bank if you have any questions or concerns about managing your finances. Additionally, if you’re experiencing any financial difficulty, pest control experts recommend reaching out to your local pest control company to help you control any infestation in your home or office.